Why High-Performance Consultancies Are Obsessed with Specificity

.jpg?width=56&name=francescorizzato8%20(1280px).jpg)

There are two questions that I expect consultancies to be able to answer in under 10 seconds: (1) Who do you work with? (2) What problem do you help them solve?

Simple, right?

No, as my years of experience have shown me. Rarely do these two questions receive instant, straight-to-the-point answers.

It is a lot more common for consulting leaders and owners to either give a generic answer (“We help businesses unleash the power of digital transformation” type) or go on a 10-minute monologue, explaining all the services the consultancy offers.

I found that this is often quite symptomatic of the larger issue that these consultancies face – the lack of specificity. I keep seeing a lot of consulting BS.

What’s more, it is not uncommon for consultancy owners and their senior leadership to not even realize that they have this problem or that it’s at the root of their business development and revenue growth struggles.

That’s what I’d like to discuss in this post – ‘specificity’ in running a consulting business.

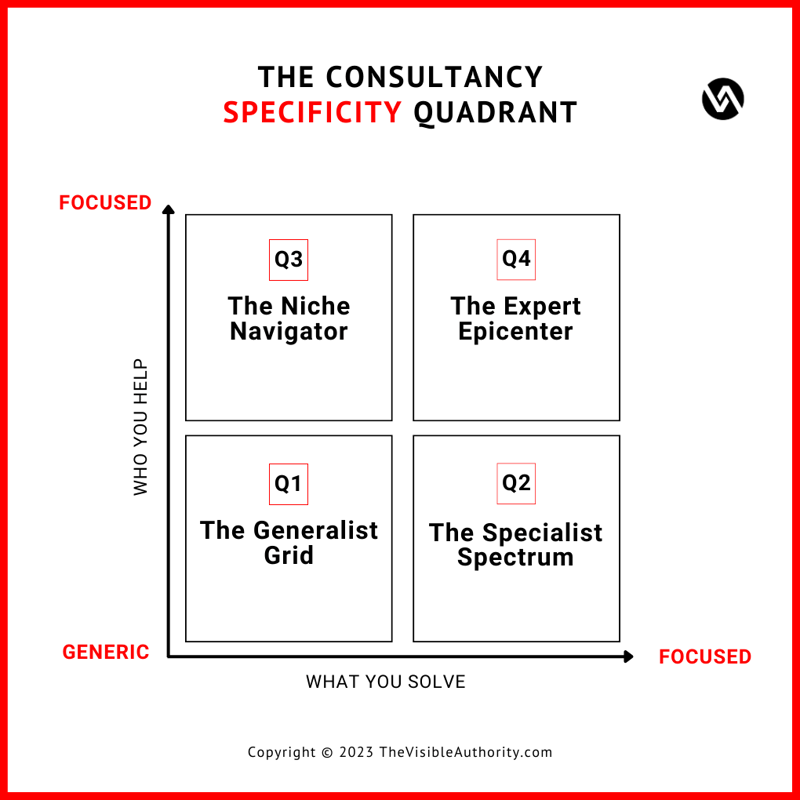

The consulting business quadrant

Imagine a matrix. On the X-axis, we have the problem(s) a consultancy solves. On the Y-axis, we have the Ideal Customer Profile (ICP) - the specific audience the consultancy works for.

I call it The Consultancy Specificity Quadrant. Here is a visual representation of it.

- The Generalist Grid (Q1) is where consultancies that offer a wide range of solutions to a broad audience are located.

- The Specialist Spectrum (Q2) is those consulting firms that have a narrow range of services but still a broad target audience.

- The Niche Navigator (Q3) is consultancies that offer a wide range of services but to a highly targeted audience.

- The Expert Epicenter (Q4) is consulting firms that were able to both narrow down their audience and the services that they offer.

Here are two examples of my former clients.

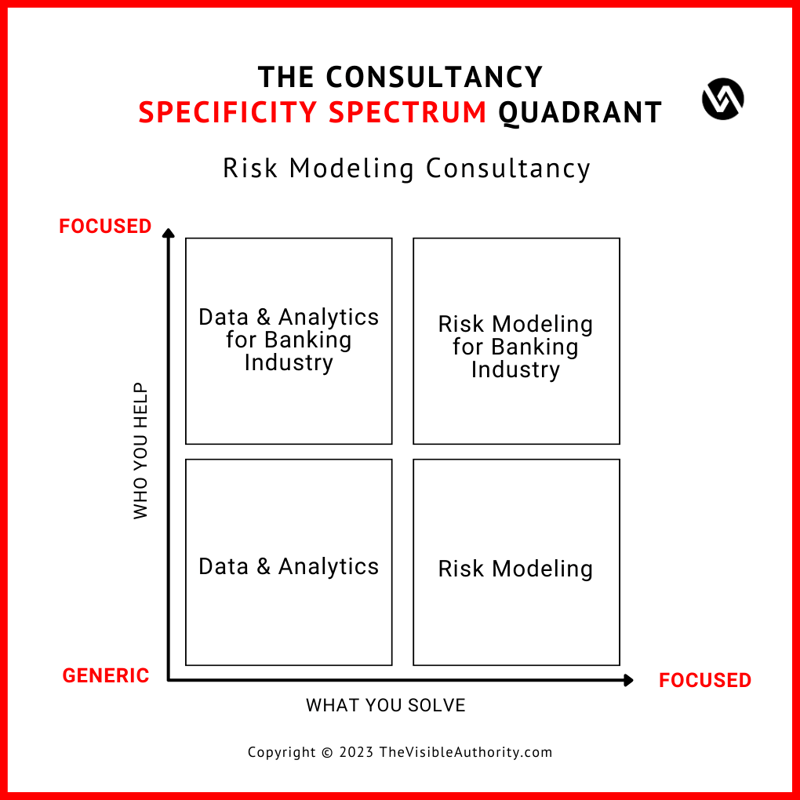

Example 1: A risk modeling consultancy

This consultancy chose a narrow target audience and a narrow area of expertise. Instead of offering data and analytics like thousands of other firms, it focused on risk modeling services for the banking industry.

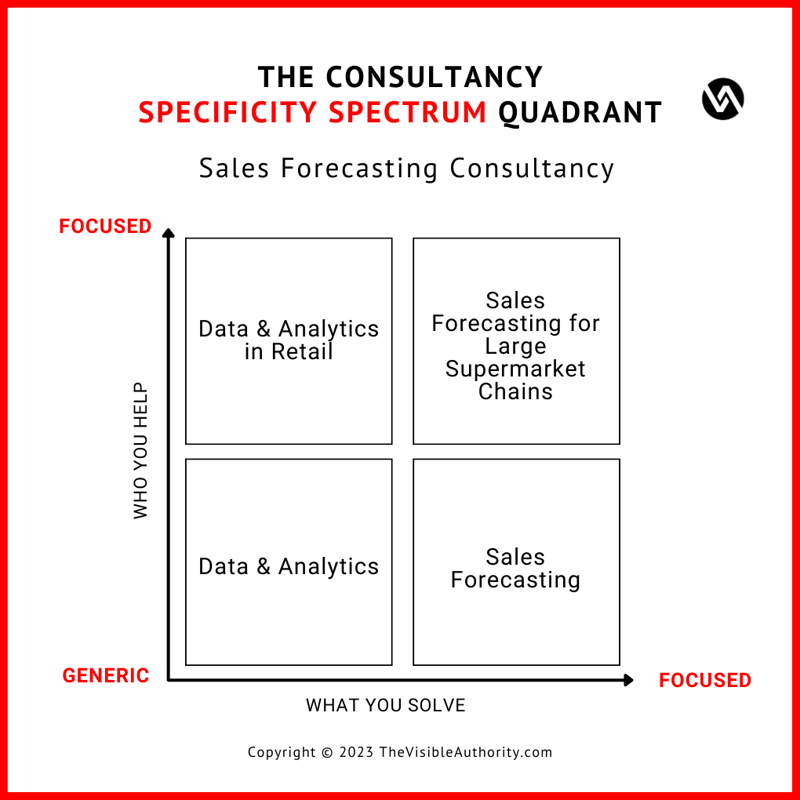

Example 2: A sales forecasting consultancy

This particular consultancy started off as a generic data and analytics firm. Over time, it narrowed down its audience to the retail industry – that’s where the majority of its decent-paying clients had been coming from. Additionally, they started paying closer attention to sales forecasting. It’s a need that they noticed across various sectors.

Eventually, this consultancy solidified its narrow positioning by becoming highly specific about both the target audience (large supermarket chains) AND the problem they are solving (sales forecast optimization).

I’d like to take a closer look at the quadrants.

Quadrant 1: data and analytics. These are generic consulting offerings. There are thousands of consultancy firms of every size that offer data and analytics services. 'Doing data analytics' is too vague. There's no specific audience, no specific problem resolution. It's a wide net cast into an ocean of possibilities, but it's not catching much. I am sure the consultancies in this quadrant play in the pricing rate race with poor margins and a lot of stress.

Quadrant 2: data and analytics in retail. Alright, this is slightly better. At least the target audience is more narrow. However, consultancies in this quadrant will still struggle to consistently get new clients, retain them, and grow as a business. They do not have a clear problem area expertise.

Quadrant 3: sales and forecasting. Here, consultancy firms have the opposite problem to Quadrant 2. The need that consultancies in this quadrant address is very clear. However, who do they work with? Which industry? Which vertical? Sales forecasting for the financial sector in B2B differs massively from sales forecasting for ecommerce brands in B2C.

Quadrant 4: sales forecasting for large supermarket chains. Now these consultancies have a clear need that they address for a very specific audience. Consultants in these firms work with large supermarket chains day in and day out, working on a single problem area – sales forecasting. When a brand like Tesco or Costco is looking for an outside partner to audit their forecasting process or implement new tech stacks into the forecasting process, who will they go with? Quadrant 4 consultancies. Who will they be willing to pay premium fees to? Quadrant 4 consultancies. Why? Because they can showcase the deepest level of expertise in a specific area for a specific audience.

Deep, targeted expertise pays.

I consider myself as a member of the ‘counterculture of committers’ (a term coined by Pete Davis) who have made it to ‘the other side’: focusing on ONE single expertise domain for a longer period of time (maybe forever), going all the way, building the deepest possible knowledge, mastering and loving my craft.

Recommended reading: (Case Study) Replicate the Secret of This Highly Profitable Consultancy

Specificity – the road to a high-performance consultancy business

The path to the upper quadrant of consulting success is paved with SPECIFICITY. It's not enough to simply offer a service. A consultancy must understand who needs the service and why.

The more specific boutique consultancy firms can be about their target audience and the problems they solve for this audience, the more value they can provide. And in the world of consultancy, value is king. That’s how mid-sized consultancies can beat the big consulting firms. I’ve been there.

I urge consultancies to avoid generic positioning in the sea of competition. Instead, consultancy firms should strive for deep expertise that can help a narrow audience solve a very specific – but highly important – problem.

That's how a consultancy can escape the pricing rate race, improve its margins, and reduce stress.

Service variety versus specificity in consulting

“We love variation in our work” – I’ve heard this more than once from a consulting leader or an owner of a consulting business.

Sure, variation is exciting at first. Working with new clients from a new industry, tackling new problems, getting to learn new approaches and technologies. Fun.

And then the reality settles in. Variation in consulting does not sell. C-level executives are not interested in paying premium fees for consultancy firms to “learn as they go”. They want to work with THE experts – those who can expertly diagnose a problem and create a fool-proof plan on how to overcome the problem.

This type of expertise comes from focus, from working with the same type of clients on the same types of problems every single day.

Most consultants tend to operate from a fear-based mindset, which causes them to take almost any work that pays and keeps their options open so they don't miss out on potential income or revenue. This reactive thinking actually strengthens the risk of remaining in mediocrity.

Recommended reading: Why Variation in Consulting Does Not Sell

And that’s why the most successful mid-sized consultancies I’ve worked with or observed – the high-performance consultancies – are obsessed with expertise depth.

In my article, Furiously Successful Consultancies Put All Their Eggs in One Basket, I explain why a narrow focus pays off big time.

The TL;DR version is: the stronger and more relevant the expertise, the more value a consultancy can deliver, which, in turn, translates into premium fees.

Operational costs go down due to the optimization of processes over time. The consultancy’s reputation gradually expands, bringing down the costs of marketing and business development. Project pipelines become more manageable and easier to forecast. Margins increase.

Variety within specificity in consulting

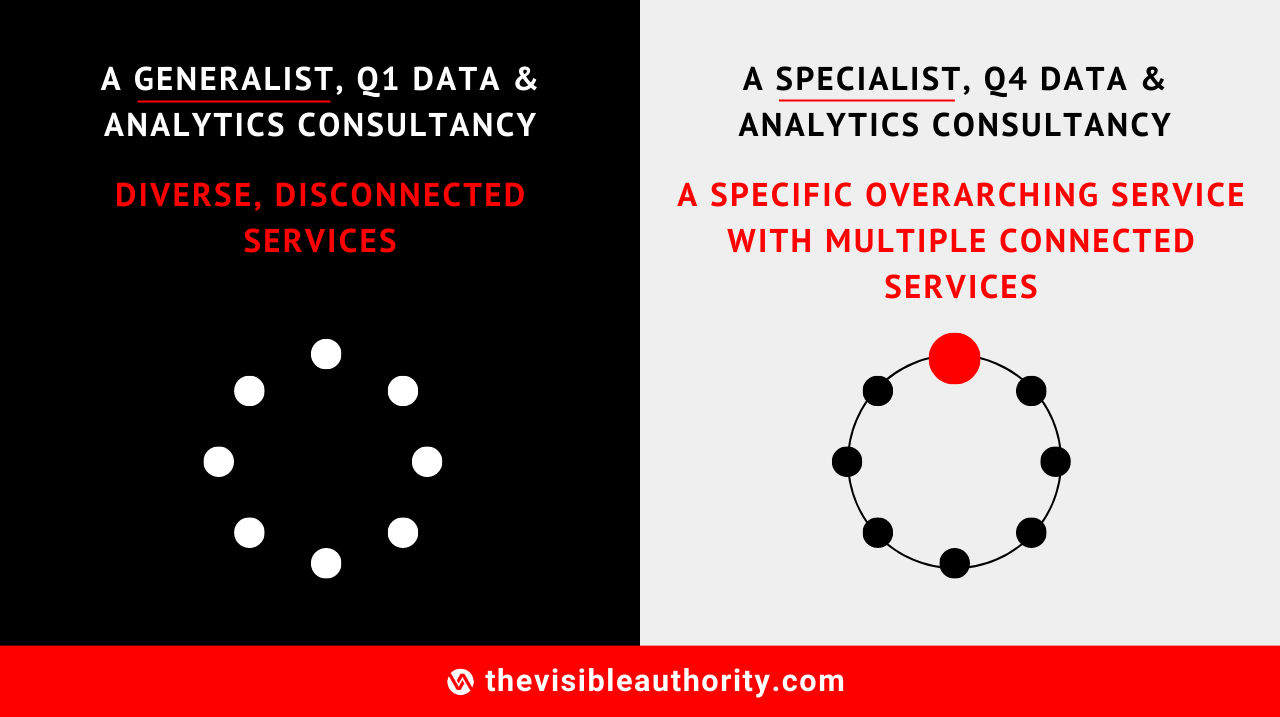

Furthermore, I do want to address the common misconception that specificity – or a narrow focus – means a lack of variety in services.

I will use the example of the Quadrant 4 consultancy firm from earlier – a specialist retail analytics consultancy that offers one main service: sales forecasting for large supermarket chains. This is a real consultancy – one of my past clients.

This consultancy, over time, developed a vertical range of underlying, connected services derived from the narrow focus (to name a few):

- store inventory management

- shopper segmentation

- pricing optimization

- store layout optimization

- fraud and theft detection analytics

You see, all these services revolve around their foundational expertise – using data to predict sales.

However, there is certainly variety in their service offering. The difference between their service variety and the royal buffet of services offered by generalist consultancy firms? They can effortlessly upsell a single client for all these services.

They still cater to the same niche market: large supermarket chains. These services make it easier to create multiple-year collaboration journeys, to set up long-term retainer-based contracts, and to generate recurring revenue from existing clients at premium prices.

These ‘connected services’ are designed to work together to address a specific need of the client within an area of expertise. Their services are not stand-alone but rather a comprehensive, overarching approach that (vertically) addresses multiple aspects of a specific problem of a specific client.

Here’s a visual that shows the distinction between Q1 and Q4 consultancies:

In conclusion

What I’ve learned the past decade is that high-performance consultancies can much better escape the stress of always hunting for new clients and competing based on pricing through specificity – by focusing on a specific area of expertise that will have a narrowly defined audience solve a high-impact (expensive) problem.

This focus enables these consultancy firms to provide more effective and efficient solutions, which will lead to more satisfied clients, better client development and long-term retention, improved reputation, targeted marketing and sales efforts, inspirational thought leadership, and more opportunities for business growth.

And what I’ve seen time and time again: repetition of similar projects (due to more specificity in positioning) leads to smooth internal knowledge transfer and cost-effective streamlining/automation of returning processes (with the opportunity to create some serious IP) and scaling without linear headcount growth. Plus, as I have experienced time and time again, these specificity-obsessed firms usually beat the big consultancy firms for client bids due to their deep – and oftentimes unmatched – expertise.

All leading to, what I always consider as the holy grail in consulting: more revenue stability, healthy (above market) gross margins, and a better quality of life for everyone in the consultancy.

Interested in receiving all my learnings to build a better consultancy?

Subscribe to my newsletter.

.jpg?width=66&name=francescorizzato8%20(1280px).jpg)

Luk’s extensive career in the consulting business, which spans more than 20 years, has seen him undertake a variety of influential positions. He served as the European CHRO for Nielsen Consulting (5,000 consultants in the EU), founded iNostix in 2008—a mid-sized analytics consultancy—and led the charge in tripling revenue post-acquisition of iNostix by Deloitte (in 2016) as a leader within the Deloitte analytics practice. His expertise in consultancy performance improvement is underlined by his former role on Nielsen's acquisition evaluation committee. After fulfilling a three-year earn-out period at Deloitte, Luk harnessed his vast experience in consultancy performance improvement and founded TVA in 2019. His advisory firm is dedicated to guiding consulting firms on their path to becoming high-performing firms, drawing from his deep well of consulting industry expertise and financial acumen.