With Improper Diversification, Consulting Firms Are at Risk to Fail

.jpg?width=56&name=francescorizzato8%20(1280px).jpg)

Most consulting firms keep adding new services because they believe more services will lead to more opportunities and revenue.

Unfortunately, more services mean more competition, more price erosion, smaller margins, thinner expertise, poorer thought leadership, less time to get visible, more hiring challenges, more training hours, more client gatekeepers to deal with, and more objections from more stakeholders, and probably 100 more fallouts.

Yet another service. But why?

To say it politely, I am not a big fan of broad and sometimes irrational diversity in consulting. We were able to grow a consulting firm year after year for a decade with only one very focused expertise domain. We always stayed in our lane and were well known for it in our markets—a thrill.

I don’t know why so many consulting firms are adding service after service.

As a professional services firm, the only product you have to sell—and what potential clients need to be persuaded to buy—is your collective expertise. In our recent study on buyer behavior, we found that across professional services, expertise was the most common selection criteria next to talented staff. (Hinge Marketing)

Just finished a new project with a client? Let’s use that project to create (yet) another new service! Did you hire a new partner or leader with yet another expertise? Let’s give him/her a new service line. Honestly, I don’t get that. Why the heck would you hire another expertise at all? When I ask them, many consulting leaders tell me: “We are diversifying to protect us from economic risk”. OK, I get that.

Unfortunately, I am a big disbeliever - yes, big - in such so-called (fear-based) economic protection-driven diversification. Smart focus and specialization are a much better protection as long as you carefully monitor the new trends and finetune when/where necessary. That works way, way better. And it is easier to manage and market.

And it is much more profitable! Yes!

Last week, I had to check out a midsized consulting firm in preparation for a positioning audit. On their homepage: “We are consulting at the intersection of strategy, organization, data, and AI”. This is an actual tagline! How the heck can you acquire AND maintain all those expertise domains under one roof?

Even if it would make sense, such a combination is the ultimate erosion of what consulting is all about: building and growing deep trust in a specific expertise domain. How can consulting firms be credible with a list of totally unconnected expertise domains? Anyway, it's probable me.

Recommended reading: To Succeed As A Consultancy, Get Rid Of The Scarcity Mindset

Diversification is more challenging to manage

Many of the diversified consulting firms are telling me the ‘risk protection story’ because they weren’t able to focus or weren’t able to agree on the direction amongst the leaders, heck.

A lot of the diversification hassle in consulting firms is just a negligent legacy problem of having added and added (and added) services in the past because the leaders believed they could make more money with more services.

But what those leaders don’t realize is the increasing difficulty of managing such a consultancy from every possible angle. And that gets translated straight into (very) deep margin erosion.

There’s a lot of ‘legacy dept’ in big consulting firms, a too long list of services and expertise verticals that were added to the portfolio in the past and have become difficult to maintain. (Quoting a partner from a Big 4 consulting firm)

Two expertise clusters? Well, that’s like growing two consulting firms: building the processes, the methodologies, developing the marketing and business development, the hiring of the people, the training, the client management, and so on. Everything is double (or more).

Shortsighted diversification is a leaking margin bucket. In my experience with my clients, it takes 2 to 3 years to achieve robust margins after adding a new service line or expertise domain.

I sometimes get a little provocative when discussing with consulting leaders. I tell them: "Show me a consultancy P&L, and without knowing anything about that consulting firm, I am almost 100% sure I can ‘smell’ it’s either a focused or an unfocused/diversified consulting firm".

In almost 90% of the cases, heavy diversification pulls consulting firms into a downstream rate game because they compete on nearly everything and rarely have power in selling as experts. Lower income, higher costs, inefficient marketing, and utilization challenges. What else?

Over time, your service offerings just get really, really complex, and it gets disastrous. I think every once in a while, you've got to step back and say, "Okay, folks, let's start over here. What do we really want to do for clients?" (David C. Baker)

The patterns of inefficient diversification

When I audit such diversified consulting firms, here are some returning patterns. Yes, they almost always return.

- Strong inside view: The mindset is on the inward view of ‘here’s what WE do’ instead of the outward, client-centric view of ‘here’s what can be achieved’. They always seem to be in the let's-tell-our-clients-how-great-we-are mode. The diversification makes it very difficult to talk about specific expertise and even more challenging to talk about the value they can add or the impact they can have. That’s why they get into the dull (because everybody is saying the same stuff) ‘here’s what we do’ selling.

- Service orientation: The inside view almost automatically leads to a dominant service orientation vs. an expertise-driven problem resolution. These firms lead with their laundry list of services and, unfortunately, not (enough) with their expertise. Services are a means to an end. The starting point is problem-resolution expertise.

- Downstream: Linked to the strong service orientation, these consulting firms are more often pulled towards downstream work, output & activity-driven vs. outcome/result-driven. Clients are more often in the lead, and arduous pitching and dealing with the procurement gatekeepers is the everyday life of the downstream (highly diverse) consulting firm.

- Rate game: Because of output/service focus, these consulting firms have a much stronger 'billing-by-the-hour/day’ project profile (because they have no authority in a specific expertise domain). As a result, most of them are stuck in the toxic rate game;

- Fear-based: Often with a tendency or risk to over-serve & under-charge to please the client (with a lot of service scope creep) or out of fear of losing the client (because the diversified consulting firm is easier to replace);

- Hitting the project wall: Lower average revenue per project, more projects needed to achieve volume, causing permanent lead-gen stress;

- Capacity stress: High volume of ‘smaller projects’ is always causing capacity and hiring challenges. Not a good time right now (hiring difficulties);

- Underperforming content: Most consulting firms understand the importance of thought leadership to demonstrate expertise. But if expertise is heavily diverse (or all over the place), this content will always be underperforming. It's not generating demand nor building trust (I hardly ever see the pain-dream-fix-educate chain because of the diversification);

- Outbound: Business development is outbound-driven, less reliable, has heavy ups & downs, is costly & inefficient (lot of work, little result);

- The Google mirror: Poor signal relevancy in Google, not strong in prototypical keywords linked to the expertise, not connected to the value proposition (Google is an excellent client mirror);

- Absent leaders: The leader's voice is not visible because these leaders are all over the place. They are stuck in their everyday hamster wheel;

- Poor margins: Much, much lower margins (between 20-50%!) because of inefficient work (covering multiple subjects), substantially higher hiring and training costs, and more struggle with retention (because everybody feels the pressure and the inefficient way of working). Have a look again at the introduction of this article, all the extra costs are listed.

Create small pockets of overarching expertise domains

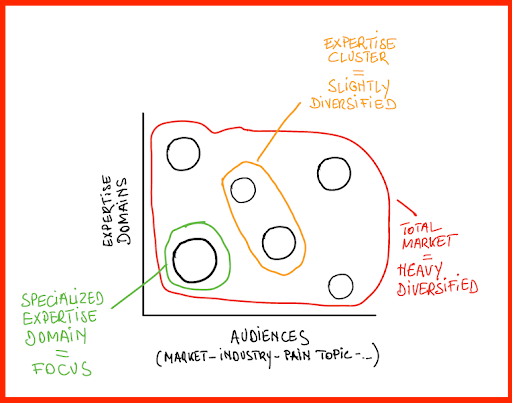

I assume my Sunday evening sketch below (fig. 1) is self-explanatory. The message: get rid of the red and orange clusters. They don’t fit together. Naturally, they cover multiple audiences and multiple expertise dimensions.

Consider it like this (that has always helped my focus-thinking): focusing on a focused expertise cluster (green color) will most likely lower the typical client resistance for consultants.

In all other cases (orange and red), consultancies will increase resistance, meaning they will have to market, pitch, propose, sell, persuade, and negotiate much more. The result: more costs, less profit. And sleepless nights. Been there (and will never go back).

About the red cluster: there’s no specific audience (total market). It has a broad service menu (‘we work at the intersection…’) in multiple expertise domains. This would be my nightmare consulting firm. I am talking a lot to these one-stop-shop, full-service, end-to-end consulting firms (mainly in the digital space). They are all in the red cluster, battling the toxic rate game because they compete on almost everything with everybody. More services, more income? Forget it. There's no direct correlation.

Unless these firms would be able to…

- mirror a specific client life cycle with their end-to-end or one-stop-shop services (a specific service for a specific moment in the life cycle, which I doubt is possible) or…

- make most clients use the majority (>70%) of ALL the services, ALL the time. In that particular case, I’d say congratulations. It would be a rare case of a more profitable, easier-to-manage diverse consulting firm.

Fig. 1: Pockets of expertise

Lead with expertise. Grow vertically.

OK, I am sure not everybody will agree with my point of view. But…I am considering consulting business growth from a few very specific perspectives, and I am sure you will all love them:

- Consistently invest in marketing (creating demand at the expertise level) & business development (capturing the demand for the problem-resolution expertise);

- Improve the depth of expertise (repetition of work & pattern recognition) to vertically grow with new and improved knowledge;

- Educating the audience to build trust (or lower the typical resistance for consultants) in problem-resolution expertise, becoming the go-to experts with inspiring case studies, thinking shifts, referenceable clients, and leading thoughts;

- Staying away from the (downstream) rate game, always striving for (upstream) premium pricing, adequately covering for forceful marketing and biz dev efforts;

- Making sure that the premium pricing supports upmarket margins, avoiding having to (horizontally) move to the next shiny service to earn money.

Recommended reading: Lead with your expertise, not with your consulting services

Are you keen to grow your expertise-driven consulting firm or practice? Think vertically first!

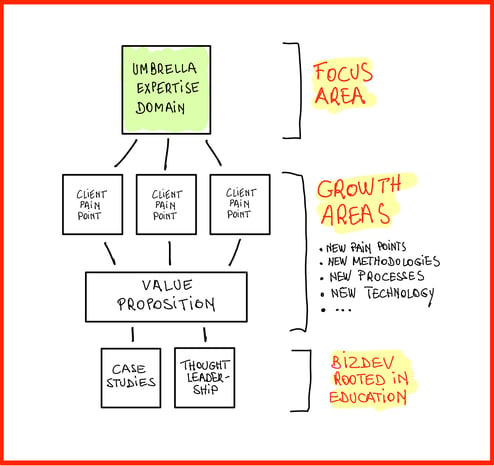

Have a look at the sketch below. Growth is at these two levels:

- at the level of the client's pain points. Discover their new challenges, latest bottlenecks, or recent events they have to deal with;

- at the level of the value proposition: your process, your solutions, your methodologies, your technology, etc. to deal with their new challenges.

Don’t grow first at the overarching expertise domain level (meaning, creating another expertise domain or service line). You will have to repeat everything in the new domain. I'm fine with it if that’s a credible move (with low client resistance). But don’t forget, it’ll take you 2-3 years to get back - hopefully - to the old margin levels (before the diversification), if at all.

And please, don’t underestimate the impact of the current hiring challenges on the labor market (pretty much everywhere on the globe). If consultancies grow horizontally by adding new services in diverse expertise domains, they will need to hire and train new people with new expertise all the time. And that’s a very big, costly, and risky challenge.

Growing vertically is much easier from a capacity-building point of view. I’ve been there.

Fig. 2: Growing vertically in the expertise domain

Grow at the level of the client’s pain points or the value proposition

And yes, that’s why narrow focus and consistent repetition of projects are so important! With repeated observation (due to the narrow focus), the consultancy will continuously learn more about the client's pains, challenges, and bottlenecks.

A better/deeper understanding of the clients will provide new opportunities for problem-solving approaches, methodologies, and maybe even new technologies. That’s how consulting firms can grow in an expertise-driven way.

The example of my (people analytics) consulting firm in the past decade

- Projects: We started with doing (smaller) analytical projects;

- Building the function: By doing these analytical projects, we learned that HR leaders were struggling to develop the analytical function and internal capabilities. That was our next (vertical) growth opportunity: helping them to build the function/capabilities;

- Data-driven decision-making: In the next phase, we learned that data-driven decision-making in the broader HR team/community was a problem. We started training & transforming HR departments (helping them to become more data-driven in their decision-making). It was our next-generation opportunity, with a (much) larger scope;

- Integrating into processes: In the next phase, we learned that success in data-driven HR could only be achieved through embedding/integrating analytical approaches in the core HR processes (e.g. hiring processes, performance management, talent development, etc.). That was a new consulting opportunity and again with larger scope;

- Employee Experience: Ultimately, we learned that the employee journey (with the so-called ‘moments of truth’) would be the very best way to connect the data and analytics (analyzing the employee experience). Another additional level of (vertical) expertise development and scope enlargement.

So, as you can see, over a period of almost a decade, we evolved from simple analytical projects to complex, high-ticket, upstream analytical consulting projects without leaving our overarching expertise domain. Vertical growth is king. Clients loved it. Horizontal growth (diversification with new expertise domains) is hell. Sorry. Yes, it's me.

The 'Performance Envelope' is the zone where the firm does its best work (i.e. profitable work). This zone is recognized as the firm’s core business and drives the firm’s profitability, recruitment and training efforts, rewards structure, and brand. Regrettably, these cores are unstable and are under constant external pressure from competitor encroachment, competitive innovation, pricing pressure, and commoditization. (Jeff McKay & David Kuhlman)

My final advice

Your consulting firm is highly diverse? You might leave a lot of money on the table. Cut back, reduce, refocus, simplify, and create better (interrelated) pockets of overarching expertise domains for a reduced number of target audiences.

Ask yourself: is the service diversification credible in the eyes of the client? Or the reversed question: did we reduce enough client resistance with our current expertise and reputation?

I am convinced there's no long-term risk with a narrowly (vertically integrated) focused consulting firm if you can keep a sharp eye on market trends. Forget the fairy tale about economic risk protection. That’s plain BS if, eventually, you'd constantly monitor and finetune your narrow positioning in the marketplace.

I can guarantee you: the consultancy management will become way more efficient and, as a result, the margins will substantially improve. And as a leader, you might be better protected against burnout. Seriously.

Running a diversified consulting firm would be my utter nightmare. Focus is heaven.

Do you need an external pair of eyes to look at the positioning of your consulting firm or practice? Feel free to send me a mail: luk.smeyers@thevisibleauthority.com

Interested in receiving all my learnings to become a better consultant? No spam, no BS. Pure teaching! Subscribe to my newsletter.

.jpg?width=66&name=francescorizzato8%20(1280px).jpg)

Luk’s extensive career in the consulting business, which spans more than 20 years, has seen him undertake a variety of influential positions. He served as the European CHRO for Nielsen Consulting (5,000 consultants in the EU), founded iNostix in 2008—a mid-sized analytics consultancy—and led the charge in tripling revenue post-acquisition of iNostix by Deloitte (in 2016) as a leader within the Deloitte analytics practice. His expertise in consultancy performance improvement is underlined by his former role on Nielsen's acquisition evaluation committee. After fulfilling a three-year earn-out period at Deloitte, Luk harnessed his vast experience in consultancy performance improvement and founded TVA in 2019. His advisory firm is dedicated to guiding consulting firms on their path to becoming high-performing firms, drawing from his deep well of consulting industry expertise and financial acumen.